Ca Dep Of Tax And Fee: Your Ultimate Guide To Understanding Taxes And Fees In California

Let’s face it, folks—taxes and fees are two words that can strike fear into the hearts of even the bravest Californians. Whether you're a small business owner, a homeowner, or just someone trying to make ends meet, understanding the ins and outs of the California Department of Tax and Fee (Ca Dep of Tax and Fee) is crucial. So, buckle up, because we’re about to break it all down for you in a way that’s easy to digest and—dare I say it—kind of fun!

Now, you might be thinking, "Why do I need to know about this stuff?" Well, here’s the thing: ignorance isn’t bliss when it comes to taxes. If you don’t pay attention, you could end up with penalties, fines, or worse. But don’t worry—we’re here to help you navigate the sometimes confusing world of California taxes and fees so you can focus on what really matters: living your life.

This article is your one-stop shop for everything you need to know about the Ca Dep of Tax and Fee. We’ll cover the basics, dive into some specifics, and even throw in a few tips and tricks to help you stay on top of your tax game. So, grab a cup of coffee, get comfortable, and let’s get started!

- How Many Seats In The Wells Fargo Center Unveiling The Arenas Capacity And More

- Ofelia Salazar The Iconic Latina Who Broke Barriers In Hollywood

Before we dive deep into the details, here's a quick table of contents to help you navigate:

- What is Ca Dep of Tax and Fee?

- Important Taxes in California

- Understanding Fees

- How to File Taxes

- Tax Relief Options

- Common Mistakes to Avoid

- Tips for Small Business Owners

- Tax Reform in California

- Frequently Asked Questions

- Conclusion

What is Ca Dep of Tax and Fee?

First things first, let’s talk about what exactly the Ca Dep of Tax and Fee is. In a nutshell, it’s the state agency responsible for administering California’s tax laws. They handle everything from sales and use tax to excise taxes and even some environmental fees. Think of them as the tax police, but hopefully not the kind that shows up at your door with handcuffs.

Now, why is this important? Well, if you live in California, chances are you’ve already dealt with this department in one way or another. Whether you’re buying a new car, starting a business, or simply filing your annual tax return, the Ca Dep of Tax and Fee plays a big role in your financial life.

- Exploring The World Of European Foods Import Export A Lucrative Global Market

- How To Crush Your Github Internship Dreams The Ultimate Guide

Here’s the deal: the more you know about how this department works, the better equipped you’ll be to handle any tax-related issues that come your way. And trust me, knowledge is power when it comes to taxes.

Important Taxes in California

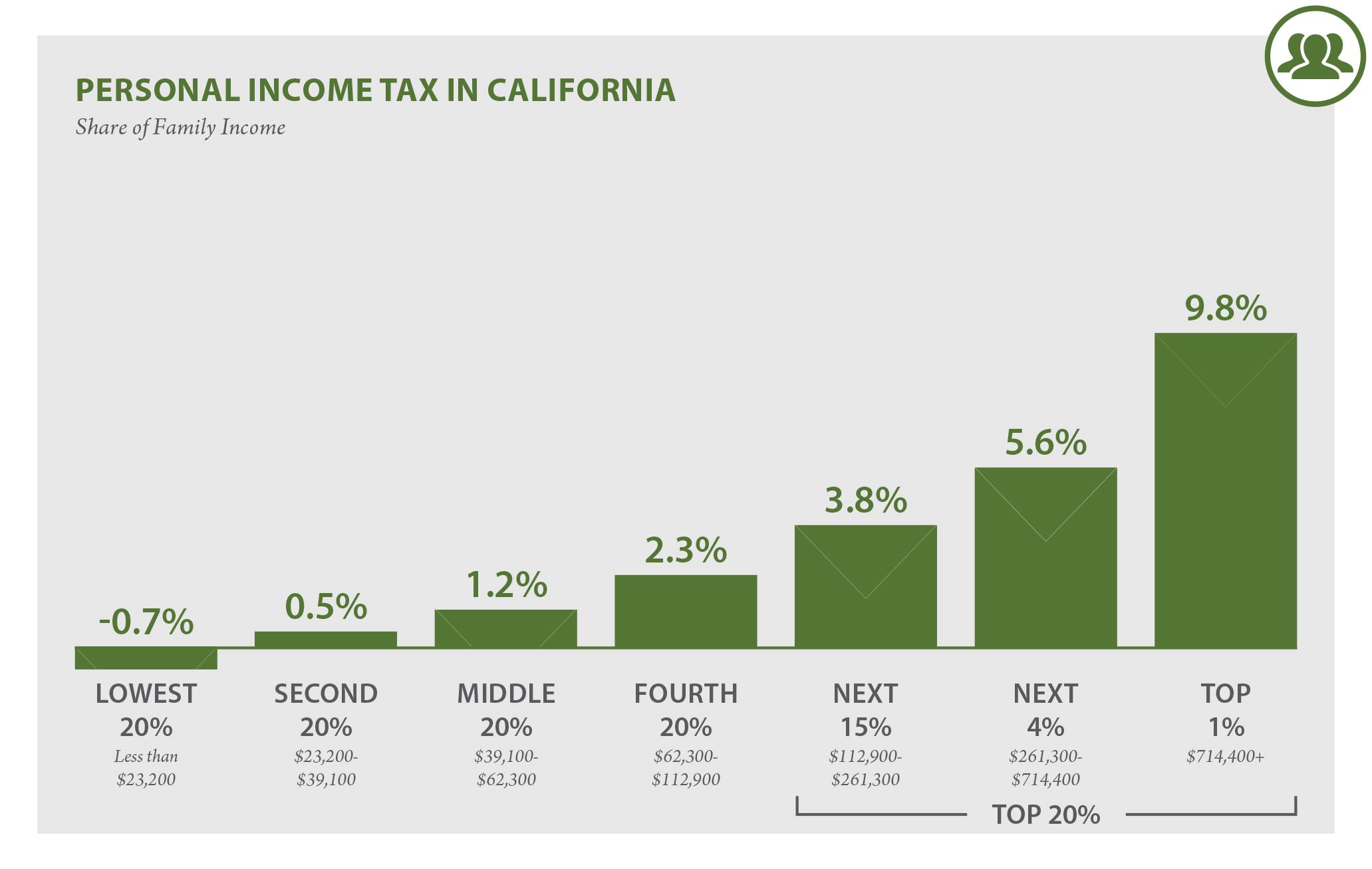

Personal Income Tax

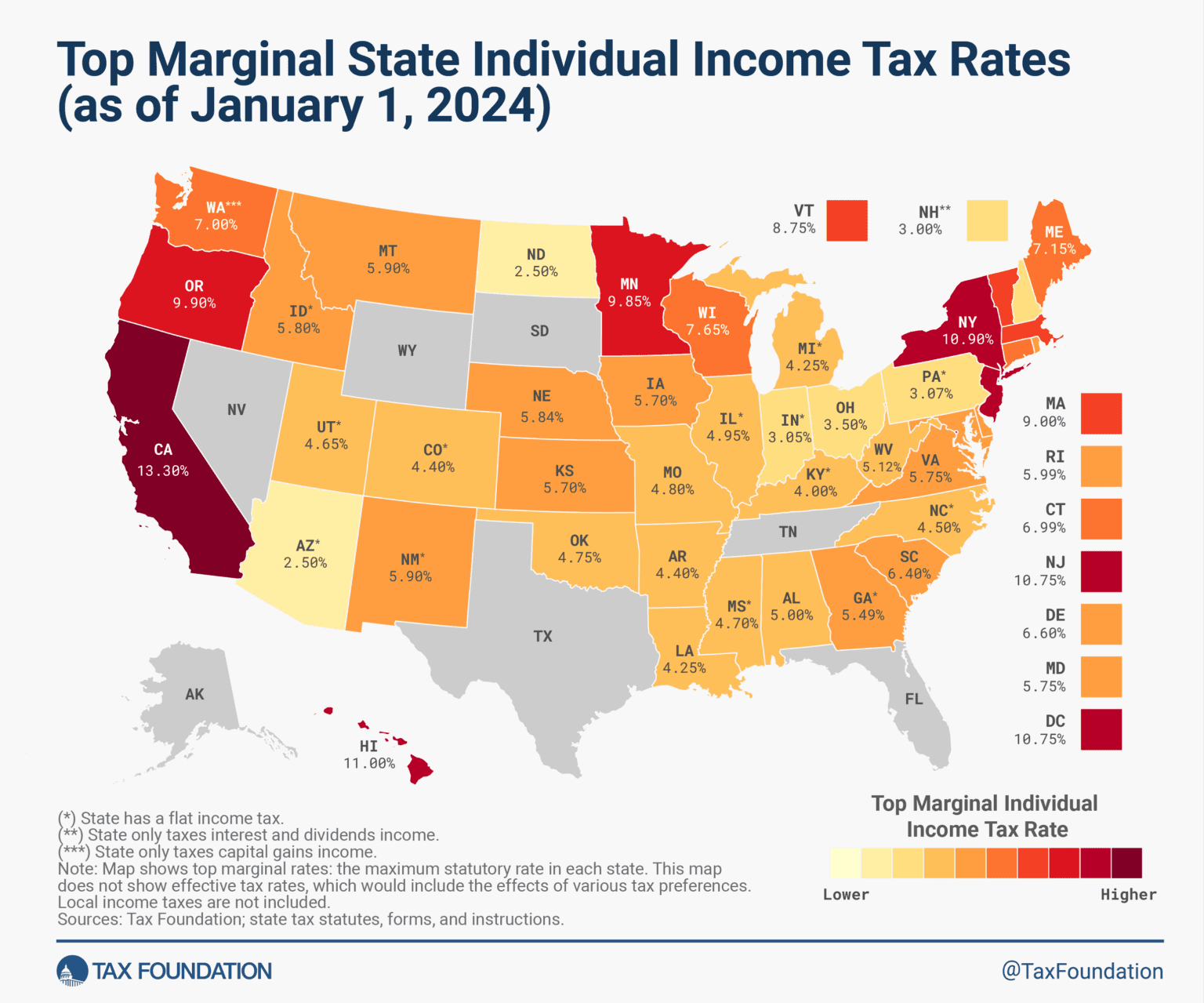

Let’s start with the big one: personal income tax. In California, this is a pretty big deal. The state has one of the highest income tax rates in the country, so it’s important to understand how it works. Basically, the more you earn, the more you pay. But don’t worry—there are deductions and credits that can help lower your tax bill.

Sales and Use Tax

Next up is sales and use tax. This is the tax you pay when you buy goods or services in California. The rate varies depending on where you live, but it’s typically around 7.25%. Keep in mind that some items, like food and prescription drugs, are exempt from this tax.

Corporate Income Tax

If you own a business, you’ll also need to pay attention to corporate income tax. This tax is levied on the profits of corporations doing business in California. The rate is currently set at 8.84%, but there are some exceptions and exemptions to be aware of.

Understanding Fees

Now, let’s talk about fees. While taxes are often based on income or purchases, fees are usually charged for specific services or privileges. For example, if you want to register a car in California, you’ll need to pay a registration fee. Same goes for getting a business license or applying for a building permit.

Here’s the kicker: fees can add up fast. So, it’s important to budget for them and understand what you’re paying for. The good news is that many fees are predictable, so you can plan accordingly.

How to File Taxes

Filing your taxes doesn’t have to be a nightmare. With the right tools and information, you can do it yourself or hire a professional to help. Here are a few tips to make the process smoother:

- Start early. Don’t wait until the last minute to gather all your documents.

- Use tax software. Programs like TurboTax or H&R Block can make the process a lot easier.

- Double-check your work. Mistakes can lead to penalties, so take the time to review your return before submitting it.

- Keep records. You’ll need them in case you get audited or have questions in the future.

Tax Relief Options

Let’s be real—sometimes life throws curveballs, and paying taxes can become a real challenge. That’s where tax relief options come in. Whether you’re dealing with financial hardship or just need a little extra time, there are resources available to help.

For example, the Ca Dep of Tax and Fee offers installment agreements for those who can’t pay their taxes all at once. They also have programs to help low-income individuals and families with tax credits and deductions.

Common Mistakes to Avoid

Even the best of us can make mistakes when it comes to taxes. Here are a few common ones to watch out for:

- Not reporting all your income. This includes side gigs and freelance work.

- Missing deadlines. Late filings can result in penalties and interest.

- Not taking advantage of deductions and credits. You could be leaving money on the table!

- Forgetting to update your information. If you move or change jobs, make sure to update your tax records.

Tips for Small Business Owners

Keep Detailed Records

If you own a small business, keeping detailed records is key. This will not only help you when it’s time to file your taxes, but it can also save you money by allowing you to take advantage of business deductions.

Stay Up-to-Date on Tax Laws

Tax laws are constantly changing, so it’s important to stay informed. Consider hiring a tax professional or attending workshops to keep up with the latest developments.

Tax Reform in California

California has been at the forefront of tax reform in recent years. From increasing the minimum wage to implementing new environmental regulations, the state is always looking for ways to improve its tax system. While some changes may mean higher taxes for certain groups, others could result in savings for others.

Stay tuned for updates, as the landscape of California taxes is always evolving.

Frequently Asked Questions

Q: Do I need to file a state tax return if I already filed a federal return?

A: Yes, you do. California has its own tax laws and forms, so you’ll need to file a separate state return.

Q: What happens if I don’t pay my taxes?

A: If you don’t pay your taxes, you could face penalties, interest, and even legal action. It’s always best to file and pay what you can, even if you can’t pay the full amount.

Q: Can I file my taxes online?

A: Absolutely! Many people choose to file their taxes online using e-filing services. It’s quick, easy, and often more secure than mailing in a paper return.

Conclusion

And there you have it, folks—a comprehensive guide to the Ca Dep of Tax and Fee. Whether you’re a seasoned tax pro or just starting to learn the ropes, understanding how this department works is essential for anyone living or doing business in California.

Remember, paying taxes is a necessary part of life, but it doesn’t have to be a headache. By staying informed and taking advantage of available resources, you can make the process as painless as possible. So, go forth and conquer your taxes with confidence!

Oh, and one last thing—don’t forget to share this article with your friends and family. Knowledge is power, and the more people who understand the ins and outs of California taxes, the better off we all are. Thanks for reading, and happy filing!

- D2 College Football Rankings Your Ultimate Guide To The Best Teams In 2023

- Terminal C Restaurants Dfw Your Ultimate Dining Guide

Tax Rate By California at Curtis Rall blog

California Tax Business What You Need to Know

California Tax Rates & Rankings Tax Foundation