Maximizing Your Fidelity Retirement Account: A Comprehensive Guide For A Secure Future

Let’s talk about something that’s gonna matter big time—your fidelity retirement account. We all know retirement is coming, whether we like it or not. It’s not just some distant dream; it’s a reality that’s gonna hit us eventually. And when it does, you wanna be ready, right? Having a well-managed Fidelity retirement account is one of the best ways to make sure you don’t end up broke when you’re older. It’s like planting seeds today so you can harvest the fruits tomorrow.

Now, I’m not here to scare you, but let’s face it—retirement planning isn’t exactly fun. It’s not as exciting as watching Netflix or scrolling through social media. But trust me, the peace of mind you get from knowing your future is secure? Priceless. Fidelity retirement accounts are one of the most reliable tools out there to help you achieve that peace of mind.

So, why Fidelity? Because they’ve been in the game for decades, helping millions of people just like you build solid financial foundations for their golden years. In this article, we’re gonna dive deep into everything you need to know about Fidelity retirement accounts, from opening one to maximizing your returns. Let’s get started!

- How Old Were The Little Rascals A Fun Dive Into Their Iconic Ages

- Nyc Subway D Train Stops The Ultimate Guide For Your Subway Adventures

Table of Contents

- What is a Fidelity Retirement Account?

- Benefits of a Fidelity Retirement Account

- Types of Fidelity Retirement Accounts

- How to Open a Fidelity Retirement Account

- Investment Options in Fidelity Retirement Accounts

- Maximizing Your Contributions

- Tax Advantages of Fidelity Retirement Accounts

- Common Mistakes to Avoid

- FAQ About Fidelity Retirement Accounts

- Conclusion: Start Planning Today

What is a Fidelity Retirement Account?

Alright, let’s break it down. A Fidelity retirement account is basically a special type of investment account designed to help you save for retirement. Think of it as a piggy bank, but instead of just storing your money, it grows it over time through smart investments. Fidelity, as a company, offers different types of retirement accounts, each tailored to meet specific needs.

These accounts come with tax benefits and are managed by professionals who know the ins and outs of the market. Whether you’re just starting your career or nearing retirement age, a Fidelity retirement account can play a crucial role in securing your financial future.

Why Choose Fidelity?

Fidelity has earned its reputation as one of the leading financial services companies in the world. They offer a wide range of investment options, low fees, and top-notch customer service. Plus, they’ve been around for over 70 years, so you know they’ve got the experience to back it up.

- City Of Mckinney Water Utilities Your Ultimate Guide

- Brad Williams Comedian Wife The Ultimate Guide To His Love Story

Benefits of a Fidelity Retirement Account

Let’s talk about the perks of having a Fidelity retirement account. There are plenty of reasons why this could be the right choice for you:

- Growth Potential: With access to a variety of investment options, your money has the potential to grow significantly over time.

- Tax Advantages: Depending on the type of account, you might enjoy tax-deferred growth or even tax-free withdrawals in retirement.

- Low Fees: Fidelity is known for its competitive fee structure, which means more of your money stays in your account.

- Professional Management: You don’t have to be a financial expert to manage your account. Fidelity provides tools and resources to help you make informed decisions.

- Flexibility: You can choose from a wide range of investment options, including stocks, bonds, mutual funds, and ETFs.

Types of Fidelity Retirement Accounts

Not all Fidelity retirement accounts are created equal. Here’s a quick rundown of the main types:

1. Traditional IRA

This is one of the most popular options. Contributions to a Traditional IRA may be tax-deductible, and the money grows tax-deferred until you withdraw it in retirement. However, withdrawals are taxed as ordinary income.

2. Roth IRA

A Roth IRA works a little differently. You contribute after-tax dollars, but the money grows tax-free, and qualified withdrawals in retirement are tax-free. This can be a great option if you think tax rates might be higher when you retire.

3. 401(k) Rollover IRA

If you’ve left a job and have a 401(k) account, you can roll it over into a Fidelity IRA. This allows you to consolidate your retirement savings and take advantage of Fidelity’s investment options.

4. SEP IRA and SIMPLE IRA

These are designed for small business owners and self-employed individuals. They offer higher contribution limits and flexibility for employers who want to offer retirement benefits to their employees.

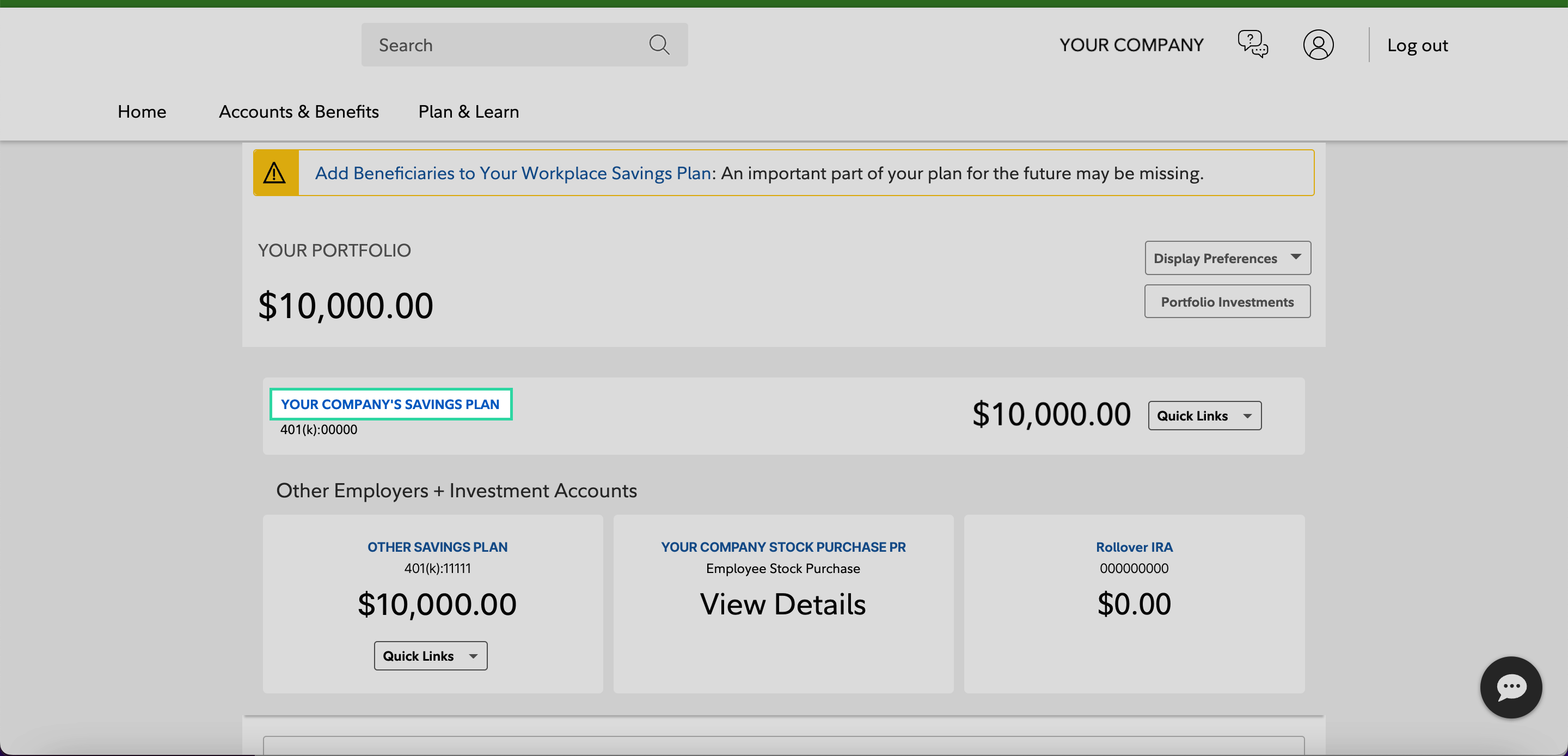

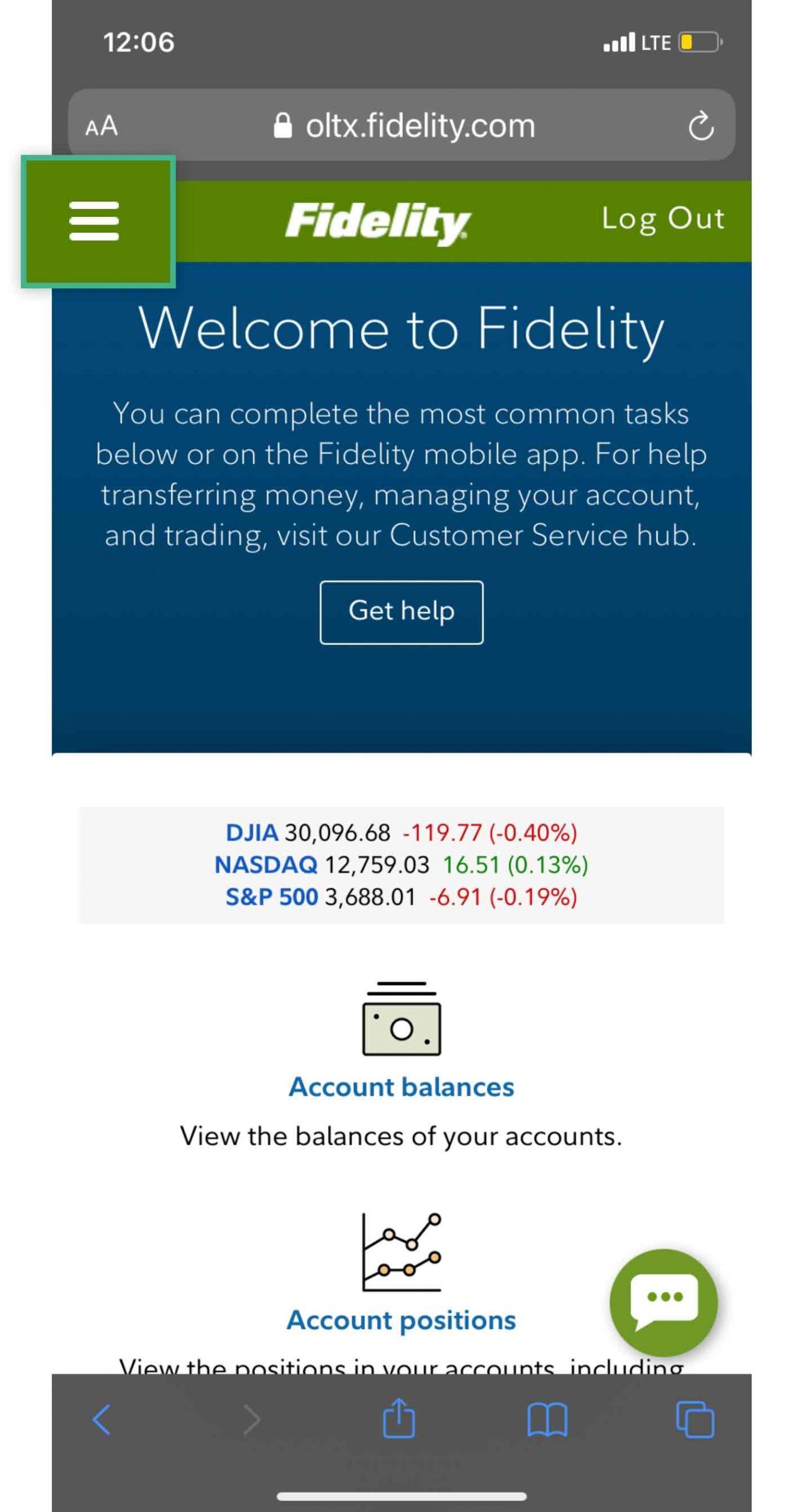

How to Open a Fidelity Retirement Account

Opening a Fidelity retirement account is easier than you might think. Here’s a step-by-step guide:

- Choose the Right Account: Decide which type of Fidelity retirement account best suits your needs. Consider factors like your income, age, and retirement goals.

- Gather Your Information: You’ll need some basic info, like your Social Security number, employment details, and bank account information.

- Set Up Your Account Online: Fidelity makes it easy to open an account online. Just follow the prompts and fill out the necessary forms.

- Fund Your Account: Once your account is set up, you can start funding it. You can either make a lump-sum contribution or set up automatic transfers.

Investment Options in Fidelity Retirement Accounts

One of the coolest things about Fidelity is the wide range of investment options they offer. Here are some of the most popular:

- Mutual Funds: These are professionally managed portfolios of stocks and bonds. They’re a great option if you want diversification without having to pick individual stocks.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade like stocks on an exchange. They often have lower fees and more flexibility.

- Individual Stocks and Bonds: If you’re a bit more adventurous, you can invest directly in individual stocks and bonds. Just be prepared to do your research!

- Target-Date Funds: These funds automatically adjust their asset allocation as you get closer to retirement. They’re a great option if you want a hands-off approach.

Maximizing Your Contributions

Contributing the maximum amount allowed by law is one of the best ways to grow your Fidelity retirement account. Here are a few tips:

- Set Up Automatic Contributions: This ensures you’re consistently adding to your account without even thinking about it.

- Take Advantage of Employer Matches: If you have a 401(k) through your job, make sure you’re contributing enough to get the full employer match. It’s basically free money!

- Reinvest Dividends: Instead of taking the cash, reinvest your dividends to compound your returns.

- Review Your Contributions Annually: As your income grows, try to increase your contributions each year.

Tax Advantages of Fidelity Retirement Accounts

Taxes can eat away at your savings, but Fidelity retirement accounts offer some sweet tax benefits. Here’s how:

- Traditional IRA: Contributions may be tax-deductible, and the money grows tax-deferred until withdrawal.

- Roth IRA: Contributions are made with after-tax dollars, but withdrawals in retirement are tax-free.

- 401(k) Rollover IRA: You can continue to enjoy tax-deferred growth after rolling over your 401(k).

Understanding these tax advantages can help you make smarter decisions about your retirement savings.

Common Mistakes to Avoid

Even the best-laid plans can go wrong if you make common mistakes. Here are a few to watch out for:

- Not Starting Early Enough: The earlier you start saving, the more time your money has to grow. Don’t wait until it’s too late!

- Withdrawing Early: Early withdrawals can trigger penalties and taxes. Try to avoid tapping into your retirement account unless absolutely necessary.

- Overpaying Fees: Keep an eye on fees, as they can eat into your returns over time. Fidelity offers low-cost options to help you keep more of your money.

FAQ About Fidelity Retirement Accounts

Q: Can I have multiple Fidelity retirement accounts?

A: Yes, you can have multiple accounts, but there are contribution limits to consider. Make sure you’re not exceeding the annual limits set by the IRS.

Q: What happens if I withdraw money early?

A: Early withdrawals from most retirement accounts come with a 10% penalty, plus you’ll have to pay taxes on the amount withdrawn. There are some exceptions, so check with Fidelity for details.

Q: Is Fidelity trustworthy?

A: Absolutely. Fidelity has a long history of providing reliable financial services and has earned the trust of millions of customers worldwide.

Conclusion: Start Planning Today

So there you have it—a comprehensive guide to Fidelity retirement accounts. Whether you’re just starting out or looking to optimize your existing account, the key is to start planning today. Retirement might seem far away, but the sooner you begin saving, the better off you’ll be in the long run.

Don’t let the fear of the unknown stop you from taking action. Fidelity offers the tools, resources, and expertise to help you build a secure financial future. So, what are you waiting for? Take the first step and open your Fidelity retirement account today!

And remember, if you found this article helpful, feel free to share it with your friends and family. Retirement planning is something we should all be talking about. Drop a comment below if you have any questions or thoughts. Let’s keep the conversation going!

- How To Crush Your Github Internship Dreams The Ultimate Guide

- What Is The Zodiac Sign For April 23rd Dive Into Your Star Signs Secrets

How to find the investment options in your Fidelity 401(k) plan

Fidelity Retirement Account Balances Rebound, Savings Rates Hit Record

4 Ways to Find Your Fidelity Account Number Capitalize