Fidelity IRA Contribution: Your Ultimate Guide To Secure Your Financial Future

Let’s face it, folks—planning for retirement isn’t exactly the most exciting topic in the world, but it’s one of the most important things you can do for yourself. And when it comes to retirement savings, Fidelity IRA contributions are a game-changer. Whether you’re just starting out or you’re a seasoned investor, understanding how Fidelity IRA contributions work is key to building a solid financial foundation. So buckle up, because we’re about to dive deep into everything you need to know to make the most of your retirement savings.

Now, you might be thinking, "Why should I care about Fidelity IRA contributions?" Well, here's the thing—Fidelity is one of the biggest names in the financial world, and their Individual Retirement Accounts (IRAs) offer some pretty sweet benefits. From tax advantages to a wide range of investment options, Fidelity IRAs can help you grow your wealth over time and ensure you’re set for life after you hang up those work boots. Plus, who doesn’t love the idea of having more money in the bank when you retire?

Before we get into the nitty-gritty, let me just say this—if you’re serious about securing your financial future, you owe it to yourself to learn everything you can about Fidelity IRA contributions. This guide will walk you through the basics, the benefits, and the strategies you need to maximize your savings. So whether you’re a beginner or a pro, there’s something here for everyone. Let’s get started!

- Maximizing Your Fidelity Retirement Account A Comprehensive Guide For A Secure Future

- What Is Mixed Martial Arts The Ultimate Combat Sport Explained

Table of Contents:

- What is a Fidelity IRA?

- Types of Fidelity IRAs

- Fidelity IRA Contribution Limits

- Eligibility Requirements

- Benefits of Fidelity IRAs

- How to Make Fidelity IRA Contributions

- Tax Advantages of Fidelity IRAs

- Investment Options in Fidelity IRAs

- Common Mistakes to Avoid

- Frequently Asked Questions

What is a Fidelity IRA?

A Fidelity IRA, or Individual Retirement Account, is essentially a retirement savings account offered by Fidelity Investments. Think of it as a special kind of investment account designed specifically to help you save for retirement. The cool thing about Fidelity IRAs is that they come with some awesome perks, like tax advantages and access to a wide range of investment options.

But here’s the kicker—Fidelity IRAs aren’t just for rich folks or financial wizards. Anyone can open one, as long as they meet the eligibility requirements. And the best part? You can customize your Fidelity IRA to fit your unique financial goals and risk tolerance. Whether you’re a conservative investor or you like to take a few risks, Fidelity has got you covered.

- Bolivias National Food Dish A Flavorful Journey Through Tradition And Culture

- Bucky Barnes Arm The Ultimate Guide To The Iconic Cybernetic Limb

Now, let’s break it down a little further. There are different types of Fidelity IRAs, each with its own set of rules and benefits. We’ll dive deeper into those in a bit, but for now, just know that choosing the right type of Fidelity IRA is crucial to making the most of your contributions.

Types of Fidelity IRAs

Traditional IRA

A Traditional Fidelity IRA is one of the most popular options out there. Contributions to this type of IRA may be tax-deductible, depending on your income and whether you’re covered by a retirement plan at work. The money in your Traditional IRA grows tax-deferred, meaning you don’t pay taxes on the gains until you start withdrawing the funds in retirement.

Roth IRA

On the other hand, a Roth Fidelity IRA works a little differently. With a Roth IRA, your contributions are made with after-tax dollars, so you don’t get a tax deduction upfront. However, the big advantage is that your withdrawals in retirement are tax-free, as long as you meet certain conditions. This makes Roth IRAs a great option for folks who expect to be in a higher tax bracket when they retire.

Rollover IRA

If you’ve left a job and have a 401(k) or another employer-sponsored retirement plan, a Rollover Fidelity IRA might be the way to go. A Rollover IRA allows you to transfer the funds from your old retirement account into an IRA, giving you more control over your investments and potentially lower fees.

Fidelity IRA Contribution Limits

One of the most important things to know about Fidelity IRA contributions is the annual contribution limit. For 2023, the maximum contribution you can make to a Traditional or Roth IRA is $6,500. If you’re 50 or older, you can also make catch-up contributions of an additional $1,000, bringing your total contribution limit to $7,500.

But wait, there’s more! The contribution limits apply to all your IRAs combined, not individually. So if you have both a Traditional and a Roth IRA, your total contributions across both accounts can’t exceed the annual limit. It’s important to keep this in mind when planning your contributions.

Eligibility Requirements

Now, let’s talk about who can contribute to a Fidelity IRA. For Traditional IRAs, anyone with earned income can contribute, as long as they meet certain age and income requirements. However, the tax deductibility of your contributions may be phased out if you or your spouse are covered by a retirement plan at work and your income exceeds certain limits.

For Roth IRAs, the rules are a little different. While there’s no age limit for Roth contributions, there are income limits. In 2023, single filers with a modified adjusted gross income (MAGI) of $144,000 or less can make full contributions to a Roth IRA. For married couples filing jointly, the limit is $214,000. If your income exceeds these limits, you may still be able to contribute through a backdoor Roth IRA, but that’s a topic for another day.

Benefits of Fidelity IRAs

So, why should you choose a Fidelity IRA over other retirement savings options? Here are just a few of the benefits:

- Tax Advantages: Whether you go with a Traditional or Roth IRA, you’ll enjoy some serious tax benefits. Traditional IRAs offer upfront tax deductions, while Roth IRAs provide tax-free withdrawals in retirement.

- Wide Range of Investment Options: Fidelity offers access to thousands of mutual funds, ETFs, stocks, and bonds, giving you the flexibility to build a diversified portfolio that aligns with your goals.

- Low Fees: Fidelity is known for its low fees and no account maintenance fees, which means more of your money stays in your account working for you.

- Customer Support: Fidelity provides excellent customer support, including access to financial advisors who can help you navigate the sometimes confusing world of retirement planning.

How to Make Fidelity IRA Contributions

Making contributions to your Fidelity IRA is easier than you might think. Here’s a quick step-by-step guide:

- Open an Account: If you don’t already have a Fidelity IRA, you’ll need to open one. You can do this online in just a few minutes.

- Choose Your Contribution Type: Decide whether you want to make a one-time contribution or set up automatic contributions. Automatic contributions are a great way to ensure you’re consistently adding to your savings.

- Fund Your Account: You can fund your Fidelity IRA with a check, electronic transfer, or even a rollover from another retirement account.

- Invest Your Contributions: Once your account is funded, it’s time to choose your investments. Fidelity offers a wide range of options, so take your time and choose wisely.

Tax Advantages of Fidelity IRAs

Let’s talk taxes, because let’s be honest—who doesn’t love saving money on taxes? Fidelity IRAs offer some pretty sweet tax advantages, depending on the type of IRA you choose.

With a Traditional IRA, your contributions may be tax-deductible, which can lower your taxable income for the year. Plus, the money in your account grows tax-deferred, meaning you don’t pay taxes on the gains until you start withdrawing the funds in retirement.

On the other hand, Roth IRAs offer tax-free withdrawals in retirement, as long as you meet certain conditions. This can be a huge advantage if you expect to be in a higher tax bracket when you retire. And since you’ve already paid taxes on your contributions, you won’t have to worry about paying taxes on the withdrawals.

Investment Options in Fidelity IRAs

Mutual Funds

Fidelity offers a wide range of mutual funds, including their own Fidelity funds and funds from other companies. Mutual funds are a great way to diversify your portfolio and gain exposure to a variety of asset classes.

Exchange-Traded Funds (ETFs)

ETFs are another popular investment option in Fidelity IRAs. They’re similar to mutual funds but trade like stocks on an exchange, offering more flexibility and often lower fees.

Stocks and Bonds

If you’re a more hands-on investor, you can also invest in individual stocks and bonds through your Fidelity IRA. This gives you the freedom to build a portfolio tailored to your specific goals and risk tolerance.

Common Mistakes to Avoid

Even the savviest investors can make mistakes when it comes to Fidelity IRA contributions. Here are a few to watch out for:

- Not Contributing Enough: It’s easy to get caught up in day-to-day expenses, but skimping on your IRA contributions can cost you big time in the long run.

- Missing Contribution Deadlines: The deadline for IRA contributions is usually April 15th of the following year, so don’t wait until the last minute to make your contributions.

- Overlooking Catch-Up Contributions: If you’re 50 or older, don’t forget about those extra $1,000 catch-up contributions. They can make a big difference in boosting your retirement savings.

Frequently Asked Questions

Still have questions about Fidelity IRA contributions? Here are some of the most common ones we hear:

Can I Contribute to Both a Traditional and Roth IRA?

Absolutely! You can contribute to both a Traditional and a Roth IRA, as long as your total contributions don’t exceed the annual limit.

What Happens If I Contribute Too Much?

If you accidentally contribute more than the annual limit, you’ll need to withdraw the excess contribution and any earnings before the tax deadline to avoid penalties.

Can I Roll Over My 401(k) Into a Fidelity IRA?

Yes, you can roll over your 401(k) into a Fidelity IRA. This is a great way to consolidate your retirement savings and gain access to a wider range of investment options.

And there you have it, folks—your ultimate guide to Fidelity IRA contributions. Whether you’re just starting out or you’re a seasoned pro, understanding how to make the most of your Fidelity IRA contributions is key to securing your financial future. So don’t wait—start saving today!

Kesimpulan

Secara keseluruhan, Fidelity IRA contributions offer an incredible opportunity to build wealth for retirement while enjoying tax advantages and access to a wide range of investment options. By understanding the different types of IRAs, contribution limits, and eligibility requirements, you can make informed decisions that align with your financial goals.

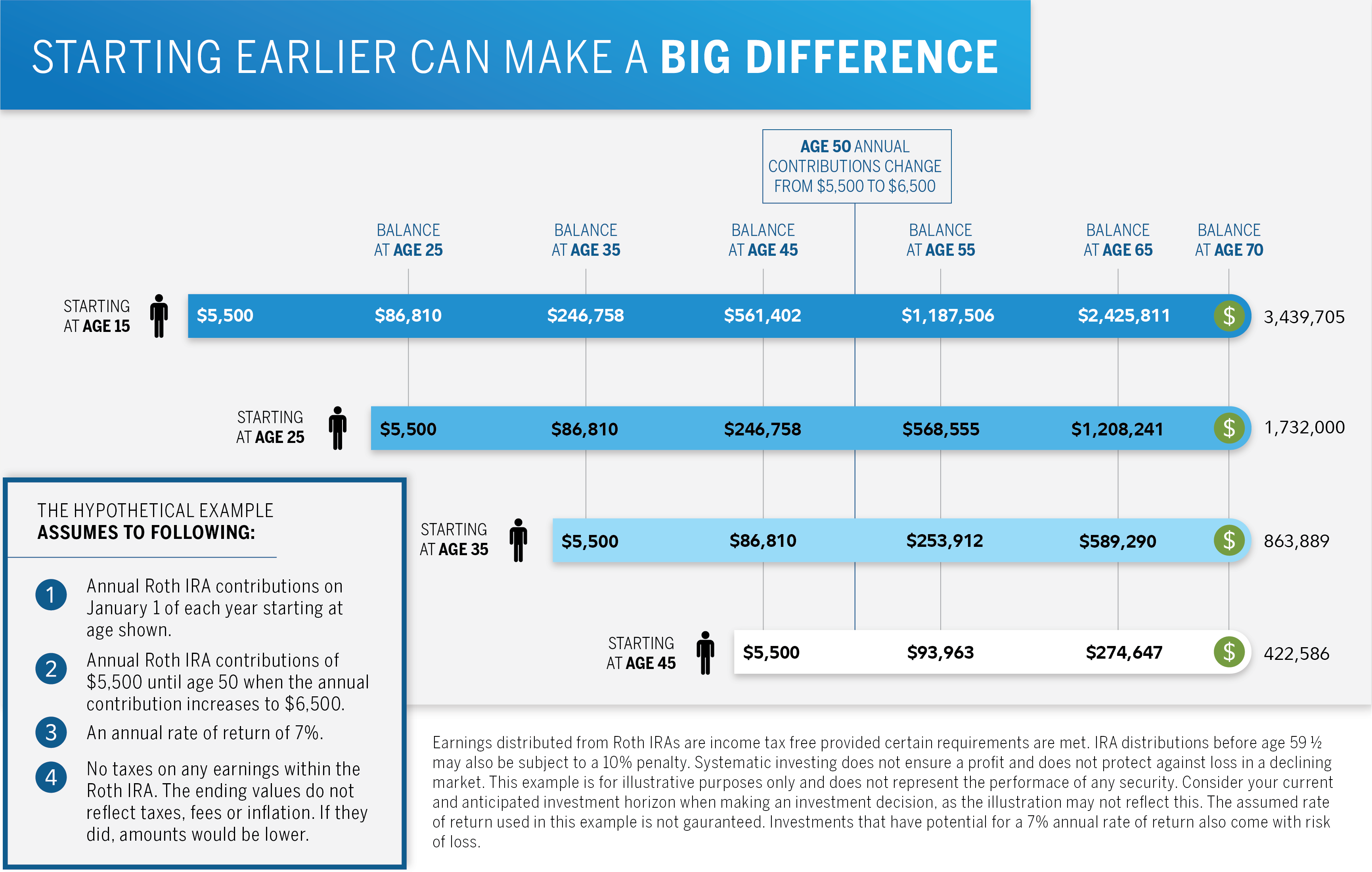

Remember, the earlier you start saving, the more time your money has to grow. So don’t wait—take action today and start contributing to your Fidelity IRA. And if you found this guide helpful, be sure to share it with your friends and family. After all, who doesn’t love talking about retirement savings, right?

- Us Military Height And Weight Requirements The Full Breakdown You Need To Know

- North Carolina Deer Tags 2024 Your Ultimate Guide To Hunting Success

Fidelity Investments® Continues to Strengthen IRA Leadership in 2019

Fidelity's Roth IRA for Kids Sees Strong Growth as Parents Prioritize

Simple Ira Contribution Limits 2025 Catch Up Holly Baskerville J.