American Debt Clock: The Ticking Time Bomb That Affects Us All

You’ve probably heard about the American Debt Clock, but do you really know what it means for you, your family, and the future of the nation? It’s not just a number on a screen—it’s a massive financial burden that impacts every American citizen. From government spending to personal finances, this clock keeps ticking louder with each passing day. So, let’s dive into what it means and why you should care.

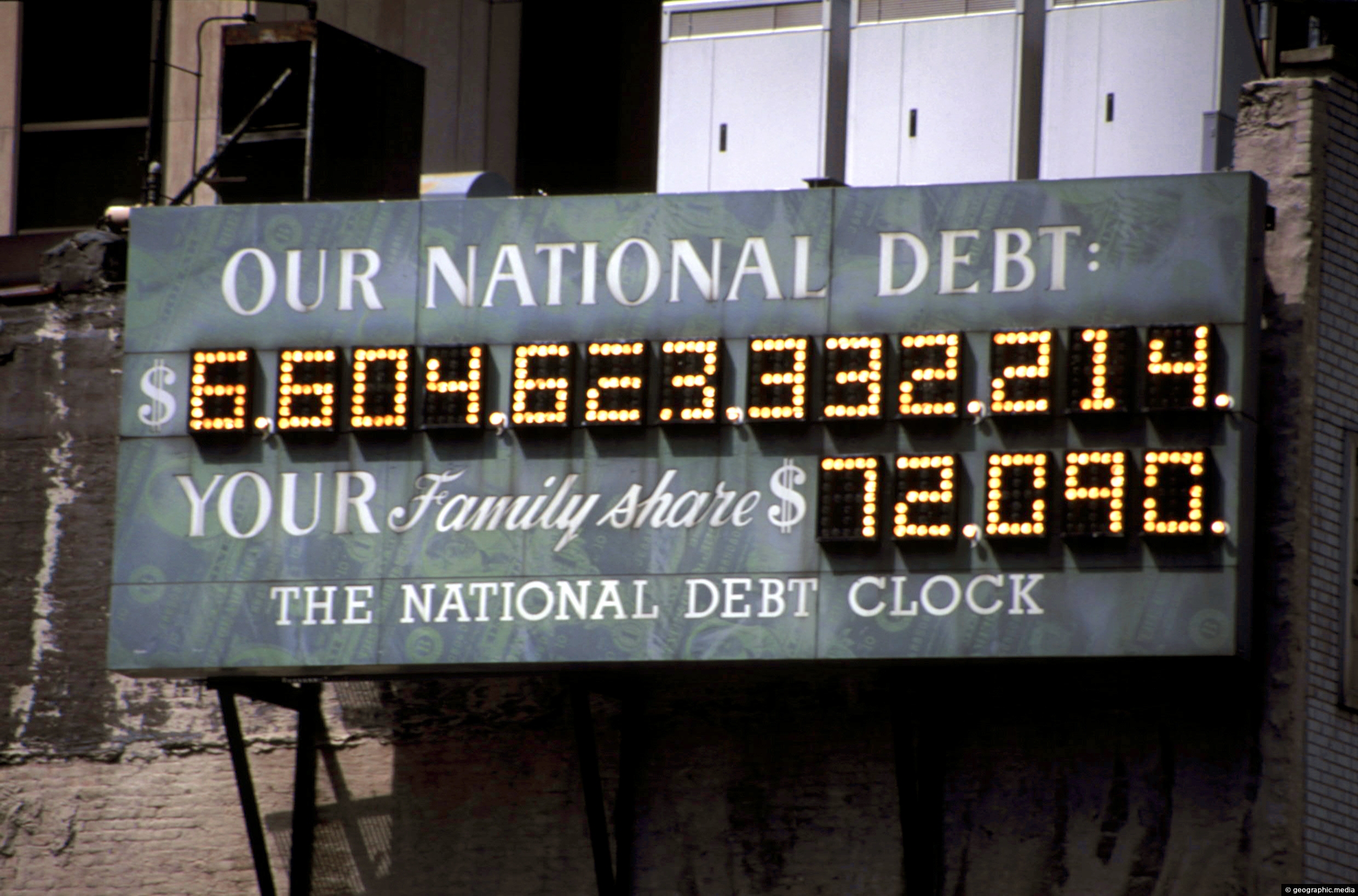

Imagine a giant digital display showing numbers so high they’re almost incomprehensible. That’s the American Debt Clock, a real-time tracker of the United States’ national debt. It’s not just a random stat; it’s a reflection of how the country is managing its finances—or, in this case, mismanaging them. If you’re scratching your head wondering why this matters, stick around. We’re about to break it down for you.

This isn’t just an economic issue; it’s a personal one too. Whether you realize it or not, the national debt affects everything from your tax dollars to the stability of the economy. And if history has taught us anything, ignoring financial warning signs never ends well. So, buckle up because we’re about to deep-dive into the world of debts, deficits, and what it all means for you.

- Aela The Huntress Unleashing The Savage Warrior Within

- 5th January Star Sign Discover Your Zodiac Personality And Traits

What is the American Debt Clock Anyway?

Let’s start with the basics. The American Debt Clock is essentially a giant digital billboard that displays the total amount of money the U.S. government owes to creditors. It’s like a massive credit card bill that keeps growing, except instead of paying it off, we’re just adding more charges. Think of it as the financial version of a ticking time bomb.

Currently, the national debt is north of $31 trillion. Yes, you read that right—trillion. That’s more than the GDP of most countries combined. And here’s the kicker: it’s not showing any signs of slowing down. In fact, it’s increasing at an alarming rate. So, how did we get here? Let’s break it down.

How Did the U.S. Get Into So Much Debt?

The short answer? A combination of factors. Wars, tax cuts, economic recessions, and massive government spending have all contributed to the ballooning debt. Think about it: every time the government spends more than it earns, it has to borrow the difference. And borrowing leads to interest, which leads to even more debt. It’s a vicious cycle that’s hard to break.

- How To Apply For A Zales Credit Card Your Ultimate Guide

- North Carolina Deer Tags 2024 Your Ultimate Guide To Hunting Success

Here’s a quick breakdown of the main contributors:

- Wars and Defense Spending: From Afghanistan to Iraq, the U.S. has spent trillions on military operations.

- Tax Cuts: While they might sound great for taxpayers, they often lead to budget deficits when the government doesn’t cut spending.

- Economic Recessions: When the economy tanks, tax revenues drop, but government spending on programs like unemployment benefits increases.

- Infrastructure and Social Programs: Building roads, bridges, and funding programs like Medicare and Social Security also add to the tab.

Why Should You Care About the American Debt Clock?

Okay, so the U.S. owes a ton of money. Big deal, right? Wrong. The national debt affects everyone, whether you realize it or not. Here’s why:

First, there’s the issue of interest payments. The more debt the government accrues, the more it has to pay in interest. And guess who foots that bill? Taxpayers. That means less money for things like education, healthcare, and infrastructure. It’s like paying off your credit card balance instead of saving for retirement.

Second, there’s the risk of inflation. When the government prints more money to pay off its debts, it can lead to inflation, which erodes the purchasing power of your dollar. That means your money doesn’t go as far as it used to.

Finally, there’s the long-term economic stability. If the national debt continues to grow unchecked, it could lead to a loss of confidence in the U.S. dollar, which could have catastrophic effects on the global economy.

What Happens If the Debt Keeps Growing?

If the national debt continues to grow, the consequences could be severe. Here’s what might happen:

- Higher Taxes: To pay off the debt, the government might have to raise taxes, which could hurt both individuals and businesses.

- Reduced Services: With more money going towards interest payments, there could be cuts to essential services like education, healthcare, and infrastructure.

- Economic Instability: A large national debt could lead to a loss of confidence in the U.S. economy, which could trigger a recession or even a depression.

Breaking Down the Numbers: What Does $31 Trillion Really Mean?

Numbers like $31 trillion can be hard to wrap your head around. To put it into perspective, that’s roughly $90,000 for every person in the U.S. That’s a lot of money, and it’s only going to get worse if something isn’t done soon.

But here’s the thing: the national debt isn’t just a number. It’s a reflection of the country’s financial health. And right now, the patient is on life support. The question is, will we pull the plug or find a way to stabilize the situation?

Who Holds the U.S. Debt?

Another interesting aspect of the American Debt Clock is who actually owns the debt. You might be surprised to learn that it’s not just foreign countries. Here’s a breakdown:

- Public Debt: This includes debt held by individuals, businesses, and foreign governments. China and Japan are two of the biggest holders of U.S. debt.

- Intragovernmental Debt: This is debt that the government owes to itself, such as the money borrowed from Social Security trust funds.

Can the U.S. Ever Pay Off Its Debt?

It’s a question that’s been on many people’s minds: can the U.S. ever pay off its debt? The short answer is yes, but it won’t be easy. Here’s why:

First, it would require a massive overhaul of government spending. That means cutting programs, increasing taxes, or both. Neither option is particularly popular, which is why politicians tend to avoid the issue.

Second, it would require a strong, sustained economic growth. The more the economy grows, the more tax revenue the government generates, which can be used to pay down the debt.

Finally, it would require political will. Both parties would need to come together and make tough decisions, which, as we’ve seen, is easier said than done.

What Are Some Potential Solutions?

There are several potential solutions to the national debt problem, but none of them are perfect. Here are a few:

- Budget Cuts: Cutting government spending could help reduce the deficit, but it would mean sacrifices in areas like defense, healthcare, and education.

- Tax Increases: Raising taxes could generate more revenue, but it could also hurt economic growth and discourage investment.

- Economic Growth: Encouraging economic growth through policies like tax reform and deregulation could help generate more revenue without raising taxes.

How Does the National Debt Compare to Other Countries?

When it comes to national debt, the U.S. isn’t alone. Many countries around the world are dealing with similar issues. Here’s how the U.S. stacks up:

Japan, for example, has a higher debt-to-GDP ratio than the U.S., but its economy is still relatively stable. That’s because most of its debt is held domestically, which reduces the risk of a foreign debt crisis.

On the other hand, countries like Greece have struggled with massive debt, leading to economic instability and austerity measures. It’s a cautionary tale for what could happen if the U.S. doesn’t get its financial house in order.

What Can You Do About the National Debt?

While the national debt might seem like a problem that’s out of your control, there are things you can do. Here’s how:

- Stay Informed: Educate yourself on the issue and stay up-to-date on the latest developments.

- Vote: Use your voice to elect leaders who prioritize fiscal responsibility.

- Invest Wisely: Protect your finances by investing in assets that can hedge against inflation and economic instability.

Conclusion: The Clock is Ticking

So, there you have it—the American Debt Clock in a nutshell. It’s a massive financial burden that affects everyone, whether you realize it or not. From higher taxes to reduced services, the consequences of a growing national debt are real and significant.

But here’s the good news: it’s not too late to turn things around. With the right policies and political will, the U.S. can get its financial house in order. The question is, will we act in time?

So, what do you think? Is the national debt a problem worth worrying about, or is it just another number on a screen? Let us know in the comments below, and don’t forget to share this article with your friends and family. Together, we can start a conversation about the future of our finances.

Table of Contents

- What is the American Debt Clock Anyway?

- How Did the U.S. Get Into So Much Debt?

- Why Should You Care About the American Debt Clock?

- Breaking Down the Numbers: What Does $31 Trillion Really Mean?

- Can the U.S. Ever Pay Off Its Debt?

- How Does the National Debt Compare to Other Countries?

- Bolivias National Food Dish A Flavorful Journey Through Tradition And Culture

- Before And After Hair Texturizer Transform Your Locks Like A Pro

The National Debt Clock in New York Geographic Media

View of the National Debt Clock in Midtown Manhattan Stock Photo

The rise of America's debt ceiling in charts World Economic Forum