California Dept Of Tax And Fee Admin: Your Ultimate Guide To Taxes And Fees

Welcome to the world of California taxation, my friend. If you're reading this, chances are you've stumbled into the wild jungle of taxes, fees, and regulations that come with living or doing business in the Golden State. The California Department of Tax and Fee Administration (CDTFA) is your go-to agency for all things related to state taxes and fees. It's like the ultimate rulebook for anything tax-related in California. So buckle up, because we're diving deep into what this department does, why it matters, and how it impacts your wallet.

Let's be real here, folks. Taxes ain't the most exciting topic in the world, but they're definitely one of the most important. Whether you're a small business owner trying to figure out sales tax or an individual wondering about excise taxes, the CDTFA has got you covered. This agency is like the tax wizard of California, handling everything from collecting revenues to ensuring compliance with state laws.

Now, I know what you're thinking. "Do I really need to know all this?" Trust me, you do. Understanding the California Dept of Tax and Fee Admin can save you from unnecessary fines, penalties, and headaches. Plus, it's always good to have a solid grasp on how your money is being managed by the state. So, let's break it down step by step and make sense of this tax labyrinth.

- Twilight Characters Dive Into The World Of Vampires Werewolves And Humans

- Percy Jackson Hellhound Your Ultimate Guide To The Fierce Creature Of Greek Mythology

What is the California Dept of Tax and Fee Admin?

The California Dept of Tax and Fee Admin, often referred to as the CDTFA, is the state agency responsible for administering and enforcing California's tax and fee laws. It's like the big boss when it comes to collecting sales and use tax, excise taxes, and various other fees. Think of it as the bouncer at a club—making sure everyone pays their dues before they get in.

The CDTFA was formed in 2017 after merging several departments, including the Board of Equalization, to streamline tax administration in California. This move was aimed at improving efficiency and providing better services to taxpayers. Today, the agency handles a wide range of responsibilities, from processing tax returns to conducting audits and investigations. In short, if it involves taxes or fees in California, the CDTFA is probably involved.

Key Responsibilities of the CDTFA

Here's the deal. The CDTFA wears many hats, and its responsibilities are vast. Let's take a quick look at some of the key things this department handles:

- Level Up Your Osrs Warm Clothes Game The Ultimate Guide

- Unveiling The Mysteries Of August 24th Birthday Personality Traits Gifts And More

- Sales and Use Tax: This is one of the biggest revenue generators for the state. The CDTFA collects sales tax from businesses and ensures that the correct amount is remitted to the state.

- Excise Taxes: Think fuel, cigarettes, and alcohol. The CDTFA oversees the collection of excise taxes on these products, ensuring that the state gets its fair share.

- Special Taxes and Fees: From cannabis taxes to tire recycling fees, the CDTFA manages a variety of specialized taxes and fees that fund specific programs and services.

- Audits and Investigations: The agency conducts audits to ensure compliance with tax laws and investigates potential cases of tax evasion.

How Does the CDTFA Impact You?

Now, here's where things get personal. Whether you're an individual taxpayer or a business owner, the CDTFA has a direct impact on your life. Let's break it down:

For Individuals: If you've ever bought something in California, you've probably paid sales tax. The CDTFA determines the rates and ensures that the correct amount is collected. Plus, if you're into luxury items like yachts or private jets, you'll definitely want to pay attention to the excise taxes that apply.

For Businesses: Businesses have it a bit more complicated. They're responsible for collecting sales tax from customers and remitting it to the CDTFA. Failure to comply can lead to hefty fines and penalties. Additionally, businesses in certain industries, like cannabis or alcohol, have to deal with specific excise taxes.

Understanding Sales Tax Rates

Let's talk numbers, baby. Sales tax rates in California vary depending on the location and the type of transaction. As of 2023, the statewide sales tax rate is 7.25%, but local jurisdictions can add additional taxes, bringing the total rate as high as 10% or more in some areas.

Here's a quick breakdown:

- Statewide Rate: 7.25%

- Local Add-Ons: Varies by city or county

- Total Rate: Can range from 7.25% to over 10% depending on the location

Common Misconceptions About the CDTFA

There are a few myths floating around about the California Dept of Tax and Fee Admin that need to be busted. Let's set the record straight:

Myth #1: The CDTFA only deals with big corporations. Wrong! The CDTFA affects everyone, from the mom-and-pop shop on the corner to the multinational conglomerate.

Myth #2: You can ignore tax notices. Not a chance. Ignoring tax notices from the CDTFA can lead to serious consequences, including penalties and legal action.

Myth #3: The CDTFA is out to get you. While it might feel that way sometimes, the CDTFA's primary goal is to ensure compliance and fund essential state services.

How to Stay Compliant with the CDTFA

Compliance is key, folks. Here are a few tips to help you stay on the right side of the CDTFA:

- Keep accurate records of all transactions and tax payments.

- File your tax returns on time, even if you don't owe any taxes.

- Respond promptly to any notices or inquiries from the CDTFA.

- Stay informed about changes in tax laws and regulations.

CDTFA Resources for Taxpayers

The CDTFA offers a wealth of resources to help taxpayers navigate the complex world of taxes. From online tools to customer service representatives, there's plenty of support available:

Online Services: The CDTFA website is packed with useful information, including tax calculators, forms, and guides. You can even file your taxes electronically and check the status of your returns.

Customer Service: Need help? The CDTFA has a dedicated customer service team ready to assist you. Whether it's answering questions about your tax return or helping you resolve an issue, they're just a phone call away.

Top 5 Tips for Navigating the CDTFA Website

Here are some tips to make the most of the CDTFA's online resources:

- Use the search bar to quickly find what you're looking for.

- Bookmark important pages for easy access.

- Sign up for email alerts to stay informed about changes and updates.

- Explore the FAQs section for answers to common questions.

- Take advantage of the tutorials and webinars offered by the CDTFA.

Common Issues and How to Resolve Them

Even the best-prepared taxpayers can run into issues with the CDTFA. Here's how to handle some common problems:

Problem #1: Late filing. If you miss a deadline, file as soon as possible and pay any penalties owed. The CDTFA may offer relief in certain circumstances.

Problem #2: Disagreement with an audit. If you disagree with the findings of an audit, you have the right to appeal. The CDTFA provides guidance on the appeals process.

Problem #3: Overpaid taxes. If you've overpaid, file a claim for refund with the CDTFA. They'll review your claim and issue a refund if appropriate.

How to Appeal a CDTFA Decision

Appealing a CDTFA decision isn't as scary as it sounds. Here's what you need to do:

- Review the decision carefully and gather all relevant documentation.

- Submit a written appeal to the CDTFA within the specified timeframe.

- Attend any hearings or meetings scheduled by the CDTFA.

- Be prepared to present your case clearly and concisely.

Future of the CDTFA

As California continues to evolve, so does the CDTFA. The agency is constantly adapting to new technologies and changing regulations to better serve taxpayers. Expect to see more digital services, improved customer support, and enhanced security measures in the coming years.

With the rise of e-commerce and the gig economy, the CDTFA is also focusing on ensuring that all businesses, regardless of size or location, comply with tax laws. This means more emphasis on remote audits and electronic filing options.

Preparing for Changes in Tax Laws

Staying ahead of the curve is crucial. Here's how to prepare for changes in tax laws:

- Subscribe to newsletters and updates from the CDTFA.

- Consult with a tax professional if you're unsure about new regulations.

- Update your accounting software to reflect any changes in tax rates or requirements.

Conclusion

So there you have it, folks. The California Dept of Tax and Fee Admin might not be the most glamorous agency, but it plays a vital role in the state's financial health. By understanding its functions and responsibilities, you can navigate the world of taxes with confidence and avoid costly mistakes.

Remember, knowledge is power. Stay informed, stay compliant, and don't hesitate to reach out to the CDTFA if you have questions or concerns. And hey, if you found this article helpful, why not share it with your friends and family? After all, who doesn't love talking about taxes, right?

Until next time, keep those tax ducks in a row!

Table of Contents

- What is the California Dept of Tax and Fee Admin?

- Key Responsibilities of the CDTFA

- How Does the CDTFA Impact You?

- Understanding Sales Tax Rates

- Common Misconceptions About the CDTFA

- How to Stay Compliant with the CDTFA

- CDTFA Resources for Taxpayers

- Common Issues and How to Resolve Them

- How to Appeal a CDTFA Decision

- Future of the CDTFA

- Jupiter Uranus Conjunction A Cosmic Dance Thatrsquos Worth Your Attention

- Snoop Doggs Son Julian The Rising Star In The Music Industry

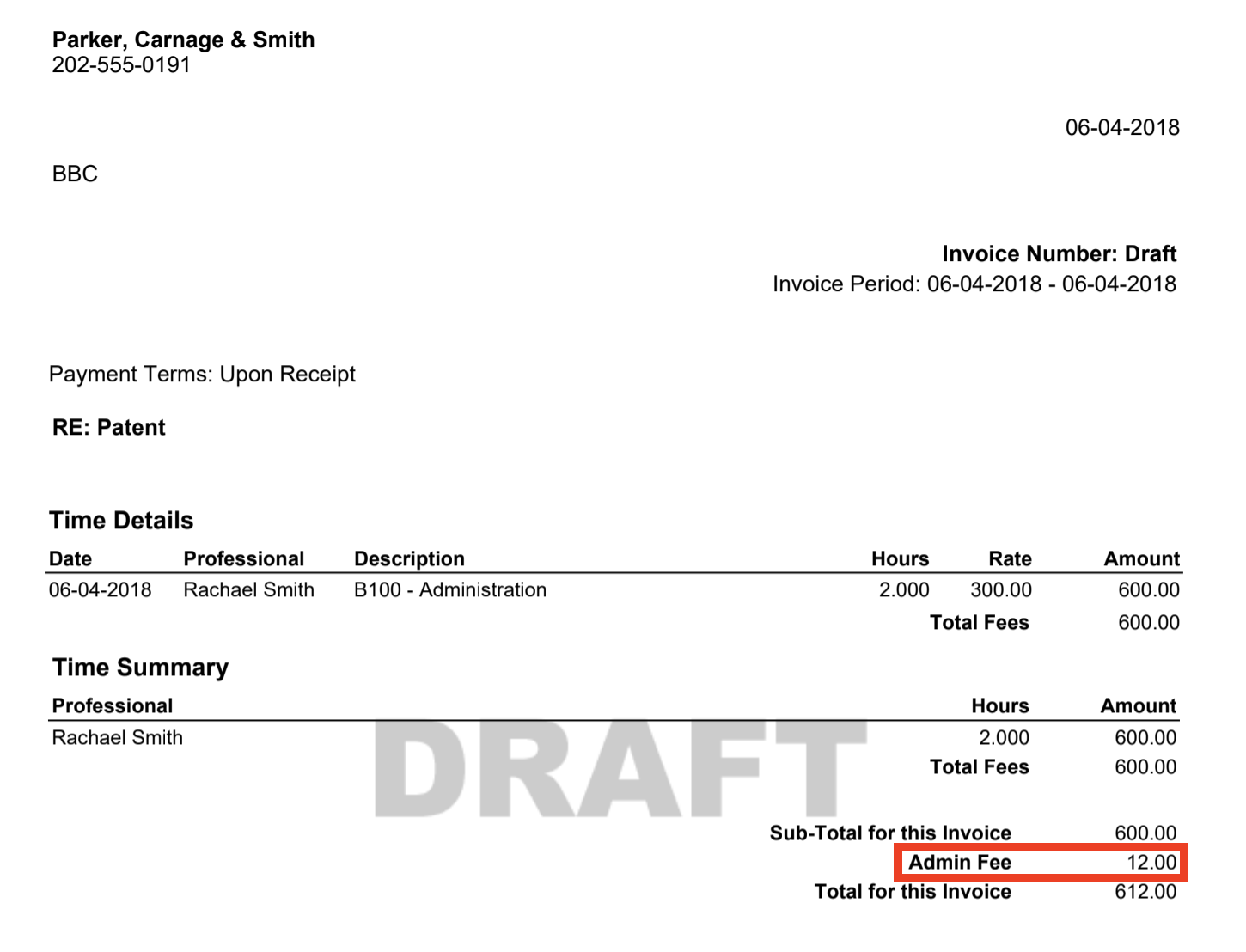

Tip of the Week Enhance Entries Add Taxes or Admin Fee

California Department of Tax and Fee Administration Home Facebook

About